We all have plans for our future and dreams for our loved ones. Whatever may come to our way of life, we never want those plans or dreams to reach a dead-end. We want life to be a smooth sailing one in spite of all the adversities. This is the primary motive behind our investment plans. Because, in bad times, financial stability does help a lot to overcome the difficulties.

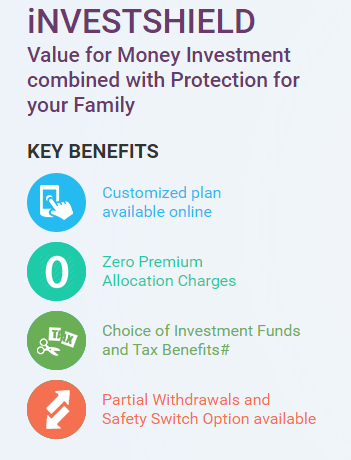

There are myriad ways to invest in these days. Let’s discuss the new ULIP investment plan soon to be launched by Canara HSBC and OBC.

What is ULIP?

ULIP is Unit-Linked Insurance Plan. It is a life insurance policy which provides a combination of risk cover and investment. ULIP is a life insurance product, which provides risk cover for the policyholder along with investment options to invest in any number of qualified investments such as stocks, bonds or mutual funds.This part protection and part investment plan provide protection features through different benefit options to suit your needs. The Canara HSBC and OBC ULIP plan helps you to achieve your and your family’s dreams while protecting them in adverse situations.

The two Indian public sector banks—Canara and Oriental Bank of Commerce along with HSBC, ensure a balanced ULIP plan for the investors. It’s a long-term protection + savings tool that provides better promenades for wealth creation along with an adequate cover.

The new Canara HSBC and OBC ULIP endeavours to provide you better solutions helping you to plan according to your family’s needs keeping in mind parameters like age, need, and time you want to stay invested.

As this is a JV of the three well-reputed organizations, the investor can play safe. Most of us are tech savvy nowadays and do extensive research before investing. But even when you pick a good policy, all your work could be undone if the policy is not able to come to your help or to your nominees’ when it is most needed. The claim settlement ratio for Canara-HSBC-OBC is over 85% for the past three years and that’s definitely an advantageous #InvestShield for the investors.

So, individuals with a medium to long-term investment idea and varying risk profiles can surely go for the Canara HSBC and OBC ULIP plan providing a better value proposition for them. Moreover, you can avoid the trouble of going through a cumbersome process and get yourself insured directly. Visit the OnlineULIP site to learn more.

Disclaimer: In Unit Linked Insurance Plans(ULIP), the investments are subject to market risk. One should understand the benefit illustration clearly before buying.

hey mani, pse checkout my new post as convenient!

LikeLiked by 1 person

Will surely do. Actually, I’m facing some problems with commenting on other blogs. My comment is going to the ‘spam’ folder 😦 It’s so frustrating that I stopped commenting on blogs for a couple of days. Contacted WP Support, hope the problem will be solved soon. :-((((

LikeLiked by 1 person

sure ma’am

LikeLiked by 1 person

Check your spam folder for my comment on “I’m Sorry” 😦

LikeLiked by 1 person

will do

LikeLiked by 1 person

Your blog is super

LikeLiked by 1 person

Thanks, Shubham, for stopping by and for the kind words… 🙂

LikeLiked by 1 person

http://fundamentalofwealth.wordpress.com

LikeLiked by 1 person

I think one should stay away from ULIP plan in case the investment horizon is short term. many people don’t understand how ULIP plans work. They are good if you invest for 10-15 years span.

LikeLike

True that… thank you, Santanu…

LikeLike

Thanks for sharing the details of the soon to be launched ULIP plan. Always good to know about different schemes available in the market.

LikeLiked by 1 person

I get so confused on money matters, not my department at home. 😛 🙂

LikeLiked by 1 person

Thanks Maniparna for giving this info.

LikeLiked by 1 person

it looks like a very good investment option 🙂

LikeLiked by 1 person

It sounds like a good plan. Very informative post 🙂

LikeLiked by 1 person

Interesting.

LikeLiked by 1 person

hmmmm….nice post

LikeLiked by 1 person

Seems to be a good plan…

LikeLiked by 1 person

I liked your blog, I invite you to my blog:

http://dishdessert.wordpress.com

LikeLike