India today is emerging as one of most prospective economies in the world. The Government has launched a whole set of new economic policies and reforms providing a great boost to the economy and, it is expected to run on a fast track for the next few years. It is high time to be a part of the growth and, take the advantage of the situation by investing smartly. The new call of Make in India, the urge to excel in every field brings about a positive feeling supportive to the economic growth at this crucial point.

Personal investment is not an easy chore to manage. With the new upcoming growth story, everyone wants to be a part of it but choosing a proper platform having a right knowledge of investment matters most. With the emerging New India growth story, the various platforms of personal finance have been transcended with immense diversification. Equities, Mutual Funds, Pension Funds, Gold Bonds, Hedge Funds or Insurances, all are coming up with different lucrative offers for the investors opening various investment avenues.

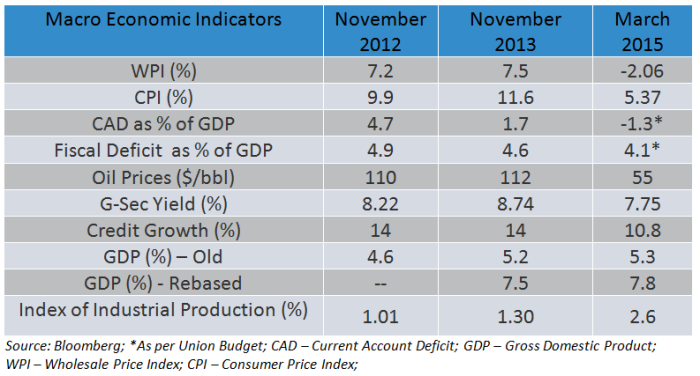

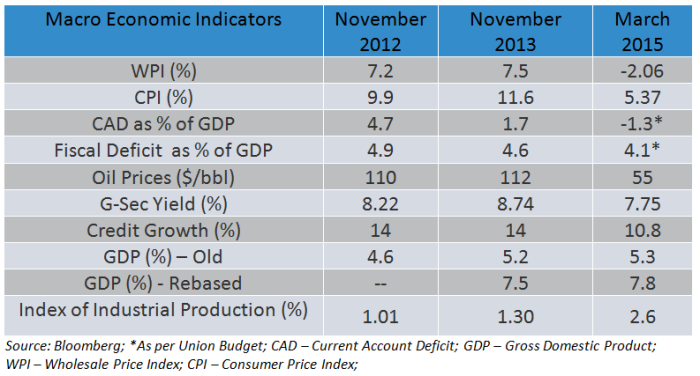

With the reformed FDI ( Foreign Direct Investment) policy, the country is now witnessing a good flow of foreign investments. Along with other reforms and laws, this has provided a specific structure to the economy while improving India’s macroeconomic structure over the past one year. Undoubtedly, it’s the high time to enter the market as the return also might be high at this crescendo.

But, the crux of managing personal finance is to choose the right platform with the right portfolio. I’m here to present one of the most efficient and happening portfolios of India at this moment, the New India Portfolio from FundsIndia.

The Product Itself

The Product Itself

FundsIndia is an online platform set up in the year 2009. Since its conception, it is striving to serve its customers with the best. It has acclaimed the Promising Brand of the Year 2015 title in the financial services category at The Economic Times Best Promising Brands Summit. The New India Portfolio is a well-researched, profit-oriented financial product aimed at driving benefit from India’s current growth revival.

Mutual Funds are a mechanism for pooling various resources and, is done by the issuance of units to the investors and investing funds. The investment is made in various sectors reducing the risk to a lower level. The New India Portfolio is made after analyzing the market at different points. The main concern for an investor is the return for his investment and the risk assessment. A well-equipped team at FundsIndia helps the customer to keep an eye on the market and understanding the financial nuances. The portfolio is focussed on consistency and stability.

The 4-Fund Portfolio

The 4-fund portfolio is a qualitative structure which ensures a good long-term return. A motley of top and revival based portfolio- it helps to create wealth steadily. The distinguishing features are:

A diversified fund: Consisting of the large caps blue chips with low volatility, the core of any stable fund with good returns.

A mid-cap fund: This consists of the mid-sized companies outperforming the market. They get benefited from the deleverage and are well placed to gain in a consistent rally.

A diversified theme fund: A multi- thematic fund investing in a wide cross-section of sectors. This eventually reduces the risk factors.

A long-term debt fund: This fund takes higher exposure in government securities provided the interest environment is conducive. Can be classified as an income fund with guaranteed returns.

Thus, on a risk-reward basis, New India Portfolio is positioned above large and mid-cap funds, but below thematic and sector funds. It is a strong, diversifying, asset-allocation based portfolio.

Is It For You?

Direct personal financial investment demands a lot of research and time on the investor’s part. It is better to use an online platform and if you are to do so, FundsIndia is pretty good with their New India portfolio. It is completely secure and provides genuine service.

So, if you are looking for a portfolio which is mostly equity-based and are willing to hold for at least 5 years, you are probably reading the right article for your investment. Find out more by visiting their website #FundsIndia.

Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund, or designing a portfolio that suits your needs.

The Product Itself

The Product Itself

Nice review maniparna, very well detailed and written 🙂

LikeLiked by 1 person

Thank you… 🙂

LikeLike

This is very good news for your country Maniparna and hopefully the trend will continue on the upward trend showing in the graph.

LikeLiked by 1 person

Thanks, Mary. We sincerely hope so… 🙂

LikeLiked by 1 person

India is an emerging country with a great future…

LikeLiked by 1 person

Thanks.for the good words, dear friend… 🙂

LikeLiked by 1 person

It sounds it delivers interesting benefits. Thanks for sharing this information 🙂

LikeLike

Thanks, Indah… 🙂 the customers are supposed to gain substantially from the product….

LikeLike

Diversified fund is a good hedge against sector specific risks. Assuming the India will ride the growth trajectory, diversified equity investment looks like a good proposition. Thanks for sharing info about New India Portfolio.

LikeLike

Right, Somali. Diversified equity investment puts one in the safer side. Hope the market will perform according to the expectation. 🙂

LikeLiked by 1 person

Fingers crossed 🙂

LikeLiked by 1 person

🙂 ….

LikeLiked by 1 person

That was complicated… 😥 Maybe cos it involves a lot of Munneeeyyy!

LikeLiked by 1 person

Not a lot of…:-P

LikeLiked by 1 person

Well, I don’t understand too much about money. But it’s a necessary evil. I will have to go back and read your post again….

LikeLike

Yeah..necessary evil..that’s for sure… 😐

LikeLiked by 1 person

i hope the benefits reach the poorest of the community

LikeLiked by 1 person

The economy is progressing, I hope one day even the poorest people will be able to get the benefits from such investments…but as of now, that’s a difficult thing indeed….

thanks for dropping by…. 🙂

LikeLiked by 1 person