Any medical emergency is likely to disrupt the life, more so when it is critical. Critical illnesses like major organ transplant (bone marrow, kidney) or cancer can completely change one’s course of life. It’s human psychology to not think of such things happening to us. But, while hoping for the best, we should prepare ourselves for the worst. And, here comes the need of a medical insurance.

Critical Illnesses Are Different

Most of the renowned life insurance companies offer health insurances as well. We should not mix up critical illnesses with normal health issues. One such illness can not only bring the family under added financial pressure but also reduces the working ability of an incoming member. So, a separate critical illness policy is very much needed to ensure the safety and security of the family.

While going through the plethora of choices regarding this, I zeroed upon CritiCare+, a critical illness insurance policy by Edelweiss Tokio Life Insurance.

Here is a review highlighting the salient features.

CritiCare+, A True Life Support

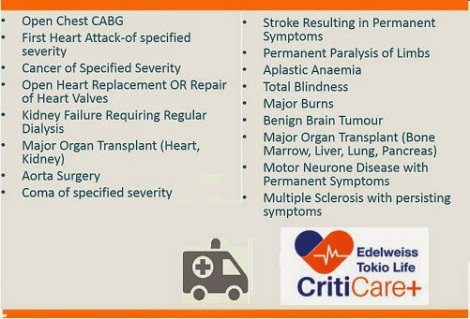

CritiCare+ covers a wide range of 17 critical illnesses, the benefit coming in the form of two options: Single Claim and MultiClaim.

Under the Single Claim Benefit, the sum assured will be given to the insured person provided the diagnosed person survives for 28 days post-diagnosis of the illness. After that, the policy will terminate.

For the other policies in the market, the survival period after diagnosis is 30 days.

Under the MultiClaim Benefit, the insured can get benefits up to 3 times, once only from a single group shown in the above GROUP TABLE.

• A waiver of the future premiums will be made after the first claim.

• 365 days waiting period is the minimum required time between two critical illness claims for MultiClaim option.

This is a unique feature of CritiCare+.

Entry Age

The minimum entry age for CritiCare+ Policy is 18 years and the maximum 65 years. The maximum maturity age is 70 years. Very few of the other companies are offering this flexibility. As we are more prone to critical illnesses with aging, this is genuinely beneficial to the investors.

Policy Term

The insured is getting high flexibility here also as the minimum policy term is 5 years while the maximum is 30. You can choose the term policy, according to your age and needs.

High Coverage

The minimum sum assured is INR 5,00,000 and the maximum is INR 1,00,00,000. The maximum coverage is higher than most of the other policies in the market.

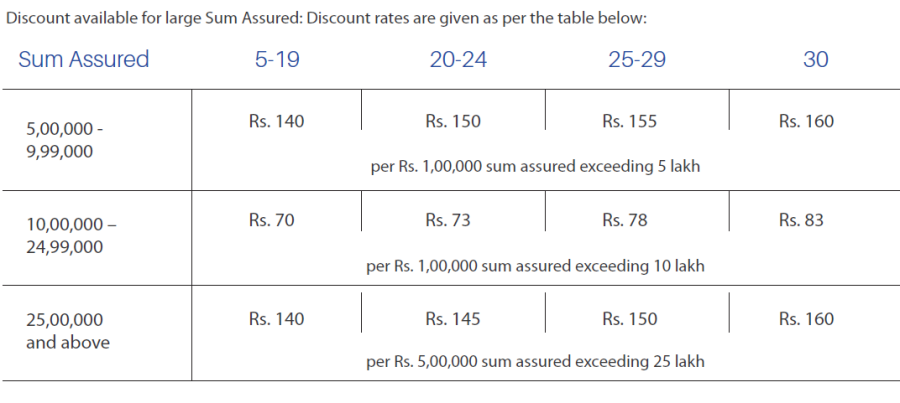

The premium rates are quite reasonable compared to other policies in the market and, a discount is available for large sums assured. Kindly refer to the table below.

Tax Benefits

Tax benefits with CritiCare+ are available under section under Section 80D and Section 10 (10D) of IT Act 1961.

Informative post soul-sis ! It is useful for a lot of people ..

LikeLike

I’m happy that you find it useful soul-sis… ❤

LikeLike

Looks like this could be helpful to a lot of people.

LikeLiked by 1 person

Thanks… 🙂 insurance is important…

LikeLike

Wonderful. 🙂 Now that is a good review of a necessary thing in life.

LikeLiked by 1 person

Thanks… insurance is indeed useful..a need for life… 🙂

LikeLiked by 1 person

Sometimes we parents see our children as life insurance 😛 😛 At least before it was like that.

LikeLiked by 1 person

Now it is not like that 😀 for various reasons not germane to this discussion…. 😛

LikeLiked by 1 person

Yup… Just telling that people are getting smarter. 😛

LikeLike

Critical illness not being covered under general health insurance, awareness wrt to these is very much required, Thanks for sharing the information Maniparna.

LikeLiked by 1 person

Thanks, Somali…yes..in general we often mix up these two things…:-)

LikeLiked by 1 person

Sensible yet informative post.

LikeLiked by 1 person

Thank you so much… 🙂

LikeLike